With e-wallets and mobile payment options on the rise, have you ever wondered: is it safe to use credit card on smartphone to pay for your purchases? It’s a legitimate concern for many of us – particularly so when news of new hacking incidents and privacy scandals are becoming increasingly frequent these days.

What are mobile e-wallets anyway? Is it safe to use credit card on smartphone? Is mobile payment technology really safe, and are mobile payment services any safer or riskier compared to paying with a standard credit card? Read on to find out.

Are mobile e-wallets really credit cards on smartphones?

It’s tempting to say that the two are synonymous with each other, but it’s really an apples-to-oranges comparison.

Mobile e-wallets do not store critically sensitive credit card information on your phone. Instead, they act as “bridges” that e-link to your credit card accounts. Many digital wallet services are encrypted software, and most can be categorized into either client-side or server-side-wallets.

This directly contrasts with traditional credit cards. Your standard credit card lacks the encryption feature that e-wallets have, instead protected only by a magnetic stripe and/or embedded microchip. Credit cards are also linked directly to your bank account.

An easier way to tell the two apart is this: Credit cards literally embody your bank account, while e-wallets serve as virtual intermediaries.

Is it safe to use credit card on smartphone versus traditional credit cards?

Because the technology that comes with a smartphone e-wallet is more sophisticated and better at preventing data theft than traditional credit cards, paying for your purchases using your e-wallet is actually a lot safer than a traditional credit card.

It takes a while to wrap your head around it; most of us still insist that credit cards are clearly safer anyway. A 2018 survey conducted by CivicScience in the USA revealed that just 1 percent of respondents used mobile payments as their primary method of payment – half of the respondents didn’t even want to touch mobile wallets for fear of security issues.

Also, this goes back to the idea that credit cards are directly connected to your bank account whereas e-wallets are not. If your credit card is compromised, you risk losing your entire bank balance; with an e-wallet however, it’s less likely you’ll encounter any fraudulent charges.

Still, there are some issues to take note of before you start using e-wallets to pay for your stuff.

5 Tips you should know before using mobile payment services

Is it safe to use credit card on smartphone? Clearly more so than standard credit cards, but that doesn’t mean you’re out of the woods yet. Using mobile payment services to pay for purchases still has some dangers and risks you should be aware of.

Tip 1: Be wary of untrusted or unverified mobile payment apps

Now this wouldn’t be a problem as long as you only download apps that are listed on the Google Play or Apple Store. Apps that are listed here are verified safe for use, unlike those made by third-party app developers and sold on external sites.

Untrusted or unverified mobile apps can corrupt your mobile phone data or install malware and viruses on your mobile device without your knowledge, and these shady mobile payment services should never ever be trusted.

Tip 2: Do not use mobile payment services on public WiFi networks

We’ve already touched on how hackers can set up rogue Wi-Fi networks that mimic the legitimate ones to lure unsuspecting users into what’s essentially a “man-in-the-middle” attack. If a user connects to these false networks, hackers can easily deceive them into revealing critical information that can be used by them to commit data theft or worse.

Basically, do not use any highly sensitive services if you’re connected to a public WiFi, even if you are connected to a legitimate one. You’d cover your PIN when using an automated teller machine, so why not do the same when using mobile payment services?

Tip 3: Watch out for phishing scams in the form of text messages

As mobile payment services become increasingly popular, so will the number of scams out to target their users. Many e-wallets typically send out notifications or OTPs in the form of text messages, and some scammers have mimicked these text messages to send phishing scams to unsuspecting victims.

Whether is it safe to use credit card on smartphone or not then depends on paying attention to the number you receive it from. If you notice a discrepancy in the number you got the notification from, refrain from opening it or tapping on any links included in it.

Tip 4: Do not use mobile payment apps on devices you do not own.

Mobile payment services have made paying for stuff super-convenient, but don’t start using them while on other people’s devices. This sounds like an odd situation, but you could easily end up in it should you find yourself short on cash.

It’s pretty much common sense – you wouldn’t expose your bank account to anybody else but yourself, so why use a mobile payment app on somebody else’s device?

The risk here goes beyond accidentally leaving personally sensitive data on the device (autofill anyone?). If the mobile device has spyware or some sort of monitoring software installed, anyone in possession of the device can see everything you just did on their cell phone.

Tip 5: Think twice before giving out your actual phone number

As fake phone number advocates, we cannot stress this point enough. Before asking are mobile payments safe or is it safe to use credit card on smartphone, you should ask if your phone number is safe.

Nowadays, all hackers really need to track you or steal personal data from you is your phone number. This wouldn’t be a problem except that because your phone number and e-wallet are both on the same mobile device, having your phone number compromised could spell bad news for your mobile payment wallet.

As safe as e-wallets are, you need to be extra-careful who you hand out your phone number to.

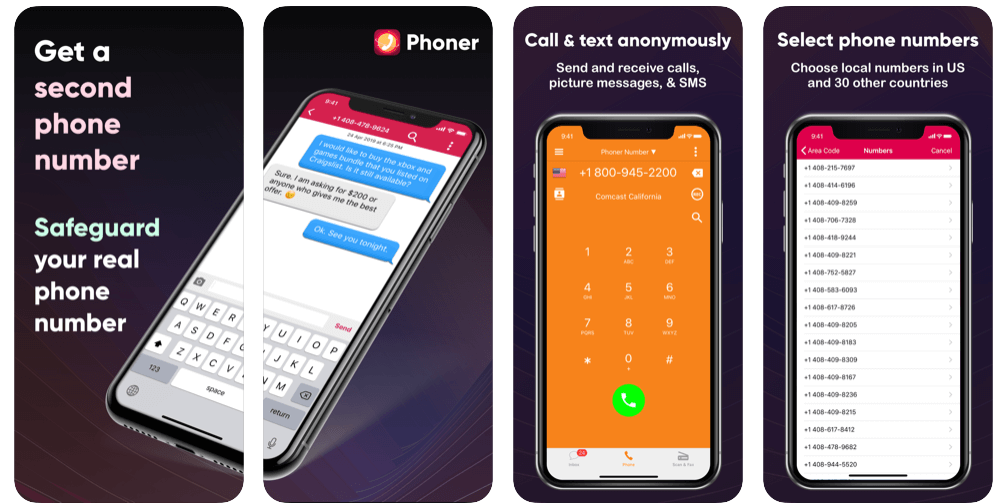

Make mobile payments safely with Phoner

This is where our very own Phoner comes in. With Phoner, you have access to unlimited phone numbers from around the world that you can immediately use, without having to get a new SIM card or phone.

With a second phone number from Phoner, you can hand out this fake phone number to anyone who asks instead of your actual phone number. This is particularly useful when you have to fill in online forms, surveys or give out your phone number in certain social or business situations that you might feel particularly comfortable with or in.

So there you have it. Is it safe to use credit card on smartphone? Yes, it’s safer than traditional credit cards, but only if you use mobile payment services the right way. Get Phoner now and make mobile payments with a peace of mind!

4.5/5 on App Store

4.5/5 on App Store